This Article will provide newcomers with essential guidance on managing the expenses associated with living in Canada. The article covers key aspects of the cost of living, such as housing, transportation, healthcare, groceries, and education. It offers practical tips and strategies to help newcomers make informed decisions, stretch their budgets, and adapt to the financial demands of their new home country. By understanding and navigating the cost of living in Canada, newcomers can effectively manage their finances and achieve greater financial stability.

Housing Costs and Accommodation

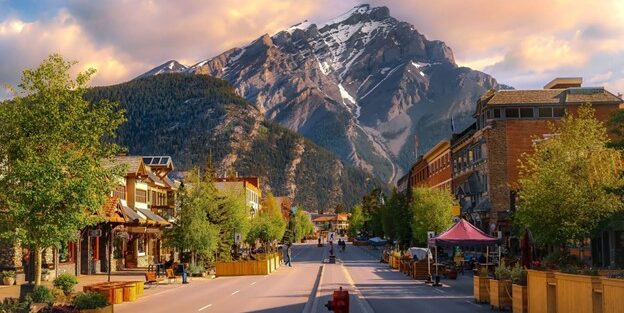

Finding suitable and affordable housing is a top priority for newcomers. The housing market in Canada varies across regions, so it’s important to research and understand the dynamics of the local market. Consider factors such as rental rates, home prices, and availability in your desired location.

Budgeting for housing is essential, and it involves considering not just the monthly rent or mortgage payments but also utilities, property taxes, insurance, and maintenance costs. Exploring housing options, such as renting, buying, or shared accommodation, allows newcomers to weigh the pros and cons and make informed decisions that align with their financial situation.

Transportation and Commuting

Transportation costs can significantly impact the overall cost of living in Canada.

Depending on the location and your lifestyle preferences, transportation expenses may include public transit fares, car ownership costs (insurance, fuel, maintenance), or even cycling and walking. Research the transportation options available in your area, compare costs, and evaluate the feasibility and affordability of each option.

Consider proximity to work or educational institutions when choosing accommodation to minimize commuting expenses. Carpooling, using ride-sharing services, or utilizing bike-sharing programs can also help reduce transportation costs.

Healthcare Expenses

Understanding healthcare costs and coverage is essential for newcomers to Canada. While Canada has a publicly funded healthcare system, certain healthcare services and medications may not be fully covered or may require additional insurance.

Familiarize yourself with the healthcare system in your province, including the process of accessing healthcare, eligibility for government programs, and options for private health insurance. Budgeting for healthcare expenses should include costs such as prescription medications, dental care, eye care, and potential emergency or unexpected medical expenses.

Grocery and Food Costs

Managing food expenses is an important aspect of the cost of living. Grocery prices can vary across regions and can significantly impact your monthly budget. To save money on groceries, consider planning meals in advance, making a shopping list, and comparing prices at different stores.

Exploring ethnic grocery stores and local farmers’ markets can often provide more affordable options. Embracing home cooking and reducing dining-out expenses can also lead to substantial savings over time.

Education and Childcare Expenses

For newcomers with children or pursuing educational opportunities in Canada, understanding the costs associated with education and childcare is crucial. Research the tuition fees, scholarships, and financial aid options available for educational programs. Consider daycare and after-school care options for children and evaluate their costs. Planning for education and childcare expenses in advance allows newcomers to create a budget and explore available resources to make education more affordable.

Conclusion

Navigating the cost of living in Canada requires careful planning, budgeting, and an understanding of the various expenses associated with everyday life. By proactively researching and assessing the costs in areas such as housing, transportation, healthcare, groceries, education, and entertainment, newcomers can make informed decisions, manage their expenses effectively, and achieve financial stability in their new homes. Budgeting is an ongoing process that will help newcomers maintain control over their finances and thrive in their new life in Canada.

Check out more on the Slideshows and Podcasts Section!